SEMI AUTOM. tyre changer with side swing arm

Product no.: TWX-11

Robust design Tyre Changer with side swing mounting arm in professional quality.

NEW: Bead press and edge protection worth £57,90 included free of charge

Product presentation

Product presentation

Assembly

Assembly

Features

Features

- Top built quality with CE- certificat

- Manufactured to ISO 9001

- Side swing mpounting arm design

- Eccentric-tension of mount and demount head

- Powerful bead breaker

- Self centered 4 clamping jaws system

- 24“ large turntable for cars and vans

- Tubeless tyre infl ating system

- Powerful E-Motor for supply and return lines

- Clamping jaws made of special steel

- Plastic protectors for mounting head / jaws

- Top qualitiy and massive construcion

Technical Data

Technical Data

Outside clamping

10“ - 21“

Inside clamping

12“ - 24“

Wheel diameter (max.)

41" (1040 mm)

Wheel width (max.)

14" (355 mm)

Bead breaker force

2500 kg

Power supply

230V or 400V

Motor power

1,1 kW / 230V | 0,75 KW / 400V

Noise level

< 70 dB

Weight

211 kg

Air supply

8 - 10 bar

WDK-Certificate

No

Perfect for motorbike rims

Yes

Optional motorbike adapter

Yes

Recomended for Runflat tyres

No

Recomended for low profile tyres

Yes

Recomended for wide tyres over 300 mm

No

Pressure regulator for service oiler

Yes

Pneumatic adjustable turntable

Yes

Note for the 400 V variant:

This product (400 V - variant) requires an increased mains voltage for its proper operation and is not equipped with a two-pin mains plug. The installation of non-plug-in units must be carried out by the respective mains operator or by a registered specialist company, which will also assist you in obtaining any necessary approval from the respective mains operator for the installation of the unit.

TW X-11 - Overview

TW X-11 - Overview

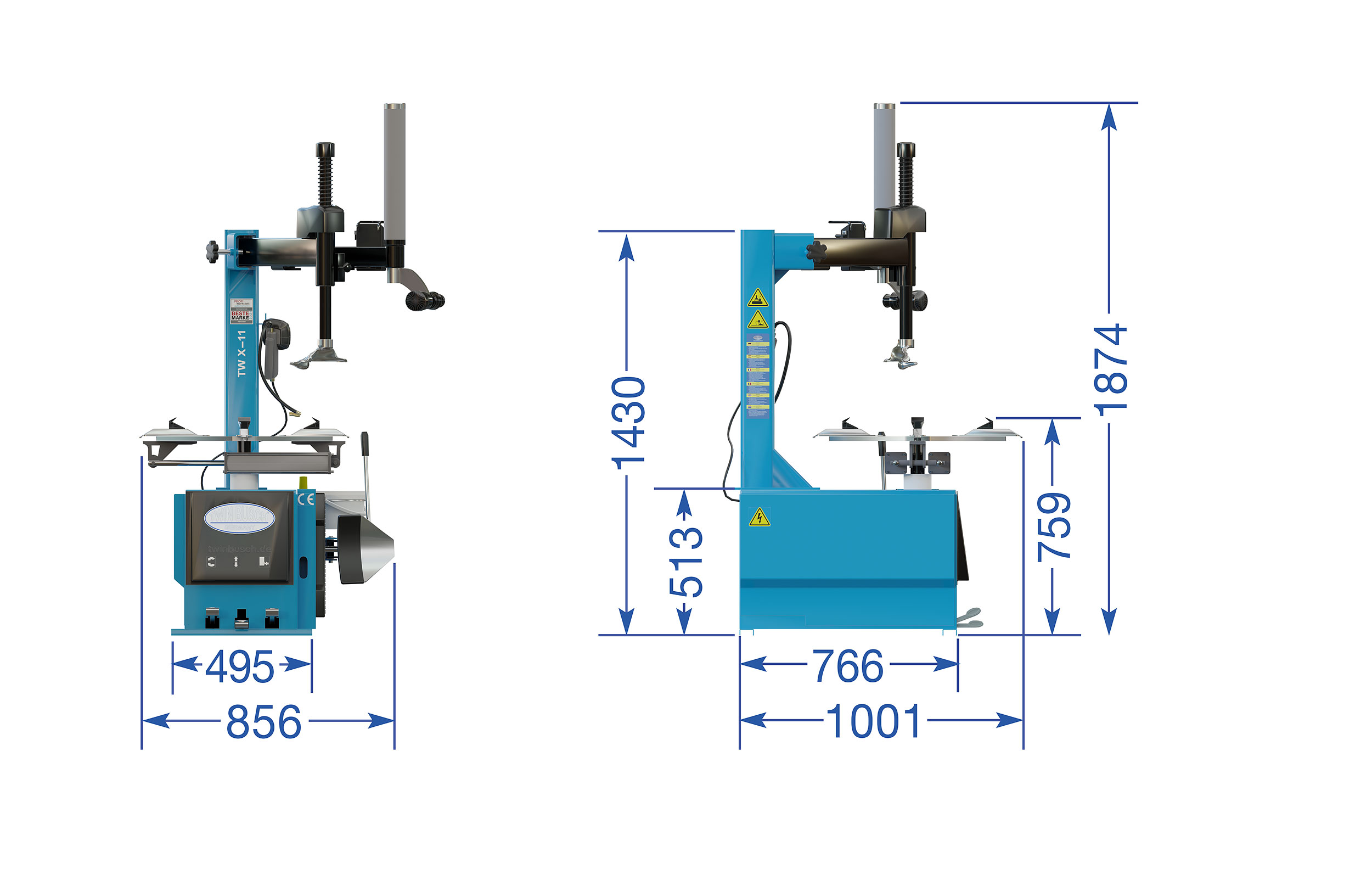

Product dimensions

Product dimensions

Delivery contents

Delivery contents

- Tyre changer with a maintenance unit

- Inflating gun and bead lever

- Bead press and edge protection

- Clamp protector for clamping jaws system (4 items)

- 3 set plastic protector for mount and demount head (for protection of alloy wheel rims)

- Product video online

- Assembly video online

- CE- certificate

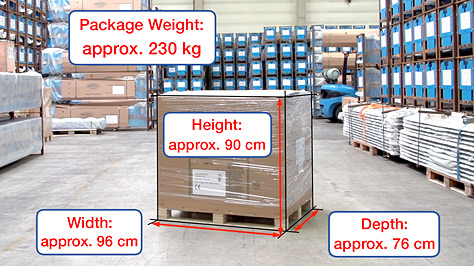

Shipping dimensions and weight

Shipping dimensions and weight

Tax included and excl. Shipping costs.

Financing / Leasing

Financing / Leasing

Finance / Leasing

Finance and Leasing Calculator

Preserves Working Capital

A Finance Lease means that valuable cash can remain in the business and used for continued growth.

Budget Control

With a finance lease the payments remain fixed for the duration of the contract so you know exactly what and when you are paying.

Protects Other Lines of Credit

Existing credit lines, such as bank overdraft or other facility, remain intact for when times are a little uncertain.

Correct Equipment Now

Why settle for inferior equipment? Spreading the cost over its useful life makes perfect sense and ensures you get what your business needs.

Upgrading

A flexible CLS Finance Lease ensures you stay ahead with advancement in technology.

Tax Efficient

Benefit from a CLS Finance Lease which is 100% allowable against pre tax profits.

Assumptions:

Equipment Cost £8250.00

Term 3 years

36 monthly payments of £284.63

Tax relief @ 21%

Lease Rental

| Year | Monthly Payments | Tax Relief @ 21% |

| 1 | £284.63 x 12 | £717.27 |

| 2 | £284.63 x 12 | £717.27 |

| 3 | £284.63 x 12 | £717.27 |

Paying Cash

| Year | Capital Allowances | Tax Relief @ 21% |

| 1 | 18% of £8250.00 = £1485.00 | £311.85 |

| 2 | 18% of £6765.00 = £1217.70 | £255.72 |

| 3 | 18% of £5547.30 = £998.51 | £209.69 |

Notes: Equipment costs and monthly payments assume vat should be added. The above are for example purposes only and tax relief is based on 21%. Always contact your accountant or financial advisor to find out what is best for your business.

FAQ

What is leasing?

Leasing is a method of business finance that allows you to spread the cost of investment in new equipment. The term is usually between 1 and 5 years and repayments are made on a monthly or quarterly basis, depending on what suits you best.

Who uses leasing?

Small, medium and large companies together with Government Departments, Schools and Colleges, Charities and many other organisations and bodies.

Can I lease if my business is new or not yet started to trade?

Yes! CLS have developed bespoke start up funding packages especially for business finance. Through our specialist funder network and Own Book, small business finance facilities, we’ve got everything covered.

How do I know if leasing is suitable for my business?

Leasing is suitable for any business and is one of the most popular ways for companies to get the equipment they need rather than settling for something cheaper and inferior. With a CLS finance lease all payments are 100% allowable against pre tax profits so it really is a common sense business finance solution.

What can be leased?

Simple, call us and we will discuss your requirements and talk you through the process. The good news is that we are approving 92% of new business enquiries!

How do I know if I will be approved?

Leasing is a method of business finance that allows you to spread the cost of investment in new equipment. The term is usually between 1 and 5 years and repayments are made on a monthly or quarterly basis, depending on what suits you best.

How soon can a lease be arranged?

Really quickly. Simply get in touch and let us know your business details, what you are looking for and how much it is and we will do the rest. Acceptances are often instant and with the introduction of EchoSign the paperwork can be dealt with in minutes. The only thing you have to wait for is your equipment to be delivered!

Are leasing rates competitive?

Yes, but even when interest rates are high a CLS finance lease remains one of the most cost effective ways to finance equipment.

Why not go to the bank?

You can, however the process may be lengthy and the underwriting strict. Also, with a straight forward bank loan you won’t be able to claim the same tax allowances that a CLS finance lease offers.

How do I know the contract is fair?

CLS are regulated by the Finance Conduct Authority and our contracts comply with the guidelines issued by The Finance and Leasing Association

E-Learning

E-Learning

In the TWIN BUSCH® "E-Learning" series we share basic knowledge about the structure of a wheel. We will cover the topics of rims, tires, valves, tyre fitting and wheel balancing.

Options:

- Power supply: 230V

Price:

£ 1,199.00

VAT incl. excl. Shipping costs