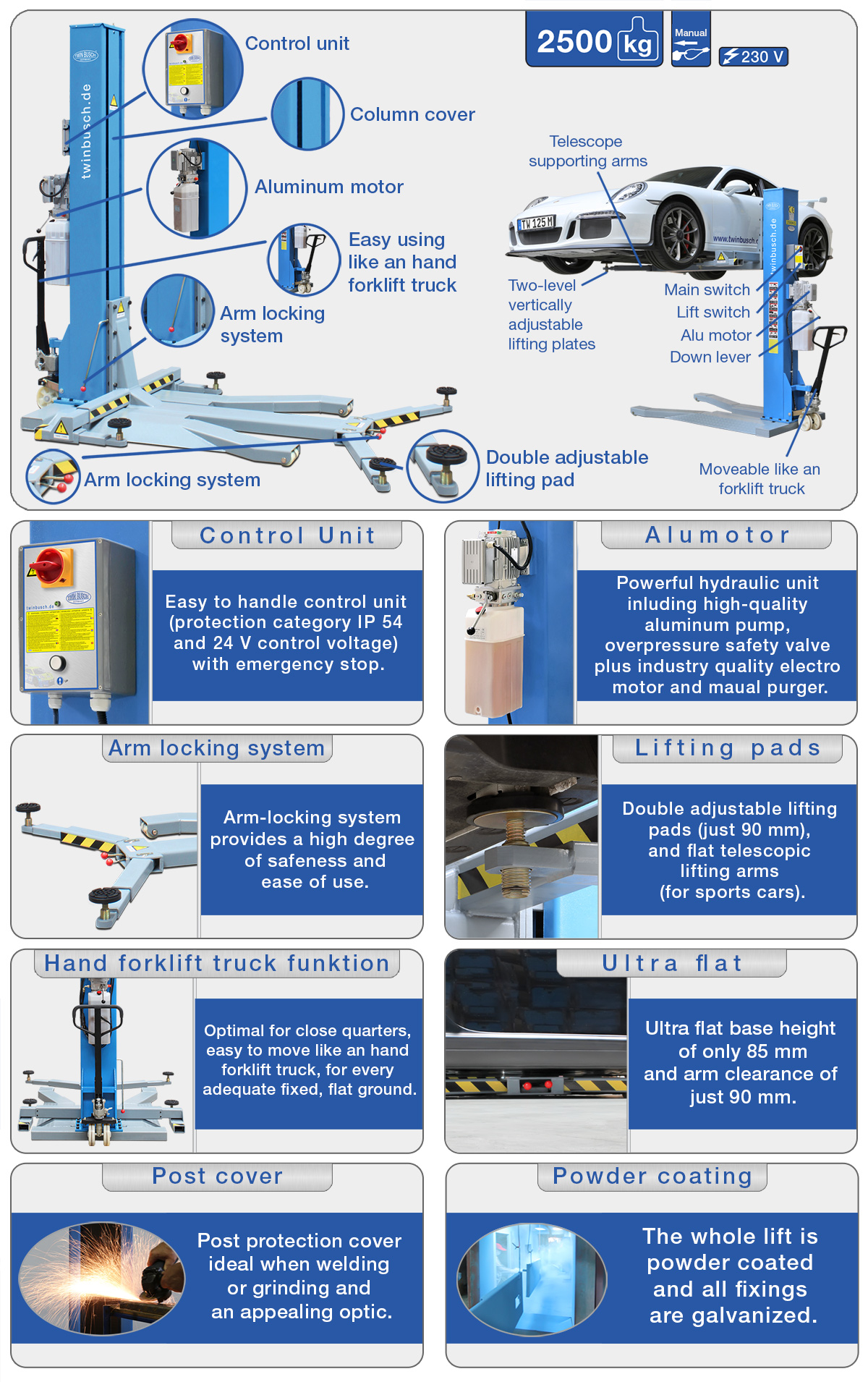

1 post lift - 2.5 tonnes - Portable - Ultra - mobile

Product no.: TW125M-230

New Model TW 125 M Ultra ultralow has a height of only 85 mm and a arm clearance of 95 mm.

Therefore it is the lowest 1 post lift available.

Ideal for small spaces it can be moved as easy as a hand lift truck and can be on any level, sufficiently solid floor.

Product presentation

Product presentation

Assembly

Assembly

Features

Features

- Top built quality with CE-certificate

- Manufactured according to ISO 9001

- Hydraulic cylinder for powerful lifting

- Adjustable lifting pads

- Telescopic lifting arms

- Mechanical safety-locks

- Manual safety lock release

- Special rolled section columns

- Aluminum-motor with 24 V - Control box

- Column chain guard

Technical Data

Technical Data

TW 125 M - Overview

TW 125 M - Overview

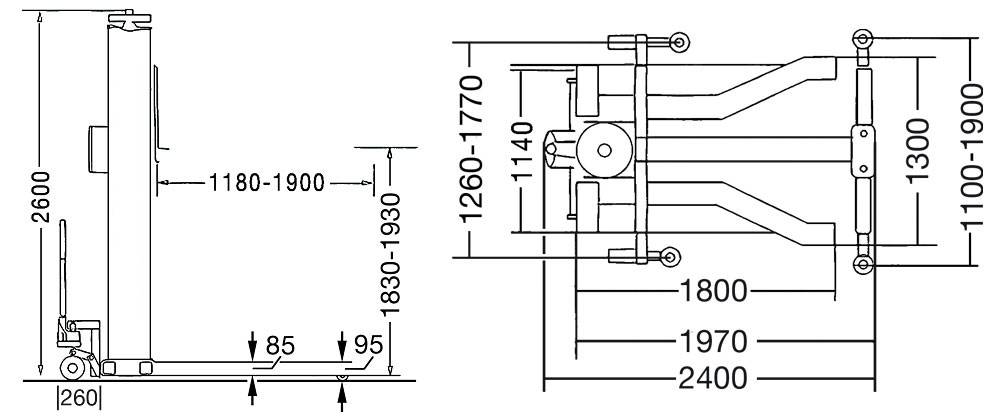

Product dimensions

Product dimensions

Vehicle type / Wheelbase

Vehicle type / Wheelbase

The illustrated vehicles are only an example to give you an understanding of different wheelbases and vehicle lengths.

Of course, a variety of other vehicle manufacturers and models can be raised.

If you have any questions, we are happy to advise you personally! +44 (0) 1536 522 960 or info@twinbusch.co.uk

Always follow the relevant equipment regulations of the vehicle manufacturer. Always observe the usual safety precautions during lifting and lowering as well as the correct load distribution, maximum load and always read the manual of the lift.

Vehicle status: 2017, Subject to technical changes and errors. The Twin Busch GmbH provides this graphic exclusively for information purposes! The Twin Busch GmbH is under no circumstances liable for recommendations from this graphic.

Delivery contents

Delivery contents

- One-post lift incl. power unit

- Operating and maintenance instructions

- CE-certificate

- Product video online

- Assembly video online

- Oil not included – can be optionally ordered

- Car not included

Shipping information

Shipping information

- The lift will arrive in a transport frame.

- Please be aware that delivery will be made by a 23 ton articulated lorry, requiring adequate space to manoeuvre and unload.

Shipping dimensions and weight

Shipping dimensions and weight

Shipping info

Shipping info

Financing / Leasing

Financing / Leasing

Tips & Tricks

Tips & Tricks

Finance / Leasing

Finance and Leasing Calculator

Preserves Working Capital

A Finance Lease means that valuable cash can remain in the business and used for continued growth.

Budget Control

With a finance lease the payments remain fixed for the duration of the contract so you know exactly what and when you are paying.

Protects Other Lines of Credit

Existing credit lines, such as bank overdraft or other facility, remain intact for when times are a little uncertain.

Correct Equipment Now

Why settle for inferior equipment? Spreading the cost over its useful life makes perfect sense and ensures you get what your business needs.

Upgrading

A flexible CLS Finance Lease ensures you stay ahead with advancement in technology.

Tax Efficient

Benefit from a CLS Finance Lease which is 100% allowable against pre tax profits.

Assumptions:

Equipment Cost £8250.00

Term 3 years

36 monthly payments of £284.63

Tax relief @ 21%

Lease Rental

| Year | Monthly Payments | Tax Relief @ 21% |

| 1 | £284.63 x 12 | £717.27 |

| 2 | £284.63 x 12 | £717.27 |

| 3 | £284.63 x 12 | £717.27 |

Paying Cash

| Year | Capital Allowances | Tax Relief @ 21% |

| 1 | 18% of £8250.00 = £1485.00 | £311.85 |

| 2 | 18% of £6765.00 = £1217.70 | £255.72 |

| 3 | 18% of £5547.30 = £998.51 | £209.69 |

Notes: Equipment costs and monthly payments assume vat should be added. The above are for example purposes only and tax relief is based on 21%. Always contact your accountant or financial advisor to find out what is best for your business.

FAQ

What is leasing?

Leasing is a method of business finance that allows you to spread the cost of investment in new equipment. The term is usually between 1 and 5 years and repayments are made on a monthly or quarterly basis, depending on what suits you best.

Who uses leasing?

Small, medium and large companies together with Government Departments, Schools and Colleges, Charities and many other organisations and bodies.

Can I lease if my business is new or not yet started to trade?

Yes! CLS have developed bespoke start up funding packages especially for business finance. Through our specialist funder network and Own Book, small business finance facilities, we’ve got everything covered.

How do I know if leasing is suitable for my business?

Leasing is suitable for any business and is one of the most popular ways for companies to get the equipment they need rather than settling for something cheaper and inferior. With a CLS finance lease all payments are 100% allowable against pre tax profits so it really is a common sense business finance solution.

What can be leased?

Simple, call us and we will discuss your requirements and talk you through the process. The good news is that we are approving 92% of new business enquiries!

How do I know if I will be approved?

Leasing is a method of business finance that allows you to spread the cost of investment in new equipment. The term is usually between 1 and 5 years and repayments are made on a monthly or quarterly basis, depending on what suits you best.

How soon can a lease be arranged?

Really quickly. Simply get in touch and let us know your business details, what you are looking for and how much it is and we will do the rest. Acceptances are often instant and with the introduction of EchoSign the paperwork can be dealt with in minutes. The only thing you have to wait for is your equipment to be delivered!

Are leasing rates competitive?

Yes, but even when interest rates are high a CLS finance lease remains one of the most cost effective ways to finance equipment.

Why not go to the bank?

You can, however the process may be lengthy and the underwriting strict. Also, with a straight forward bank loan you won’t be able to claim the same tax allowances that a CLS finance lease offers.

How do I know the contract is fair?

CLS are regulated by the Finance Conduct Authority and our contracts comply with the guidelines issued by The Finance and Leasing Association

Price:

£ 3,299.00

VAT incl. excl. Shipping costs